If you’re trying to decide if payday or traditional title loans are better can be compared to asking what disease is the most effective one to treat in winter. Both loans are subject to usury rates of interest as well as terms that are not ideal and can be a …

Read More »Jamaican currency changes over the years

Like all nations, Jamaica has seen its fair share of change and success in its 60 years as an independent country. One of the most intriguing changes is that of currency. If one were to take a sample of the notes or coins used over the six decades, it would …

Read More »Saudi commercial banks’ June deposits rose 8.7%, their highest level in 16 months

Focus on India – Trade with Russia and Sri Lanka expected to reach $9 billion; Bajaj Finance will issue 3-year bonds RIYADH: India expects two-way trade worth up to $9 billion with Russia and Sri Lanka in the next two months after allowing international trade in rupees, Indian secretary has …

Read More »Central Bank Digital Currency (CBDC), Stable Coins Could Coexist With Legal Tender: Report

According to a report titled “The Future of Payments 2022”, published by British company Finextra Research, digital assets such as central bank digital currency (CBDC) and stablecoin could coexist with legal tender in the future, but their “trajectory and impact” cannot be known immediately. Ville Sointu, former head of emerging …

Read More »Digital currency TUV / CBDC equivalent of Webtel.mobi

Global Telco Webtel.mobi briefing paper to international consultancy Frost & Sullivan for evaluation of its TUV/CBDC digital currency equivalents reveals that TUV’s fully operational capabilities exceed mainstream theories of digital currency capabilities/ CBDC to the point of being startling – and potentially heralding the biggest changes in over a century …

Read More »Businesses are feeling the benefits of a stronger currency

SINGAPORE: Companies here that deal in foreign trade as part of their business have recently felt – or are beginning to feel – the impact of a strengthening Singapore dollar. The effect goes both ways: a stronger local currency tends to make imports cheaper for businesses such as property developers, …

Read More »The role of commercial banks in the economy

Many people share a reasonably basic view of banks. They are places to buy money, make primary investments like term deposits, sign up for a credit card, or get a mortgage. Behind this mundane view, however, lies a highly regulated system that reconnects our day-to-day banking operations to the larger …

Read More »Commercial banks urged for long-term financing of manufacturing sector

Commercial banks should consider providing long-term financing to manufacturing and SMEs if the latter want to recover from the effects of the Covid-19 pandemic. This was during the annual bankers conference which kicked off in Kampala on Monday, July 25, 2022. Several panelists said that in the wake of the …

Read More »Commercial banks urged to provide long-term finance to manufacturing sector

Commercial banks should consider providing long-term financing to manufacturing and SMEs if the latter want to recover from the effects of the Covid-19 pandemic. This was during the annual bankers conference which kicked off in Kampala on Monday, July 25, 2022. Several panelists said that in the wake of the …

Read More »Banks need to modernize their core banking system – Opinion

Pakistan’s banking sector has flourished tremendously over the past few years, with steady growth in operations, customer penetration and profitability. New leagues of branchless banking operators, electronic money institutions (EMIs), POS/PSP operators, etc. emerging in the sector, bringing innovations in banking services and modes of operation, as customers move away …

Read More »NIO denies rumor of NIO digital currency issuance

With Gasgoo Daily, we will bring you important automotive news in China daily. For the ones we have reported, the title of the piece will have a hyperlink, which will provide detailed information. NIO denies rumor of NIO digital currency issuance NIO has responded to recent rumors regarding the auto …

Read More »GAC Group News – Gasgoo

With Gasgoo Daily, we will bring you important automotive news in China daily. For the ones we have reported, the title of the piece will have a hyperlink, which will provide detailed information. NIO denies rumor of NIO digital currency issuance NIO has responded to recent rumors regarding the auto …

Read More »Recovery in the euro rate against the dollar suggests a possible inflection point for the currency market

EUR/USD recovery, a possible inflection point for the market As the Fed’s interest rate speed limit may have been reached ECB plans to tackle terrain on interest rates Amid signs, Fed policy is already having the intended effect Image © European Union – European Parliament, reproduced under CC licence. The …

Read More »Commercial banks stifle growth of CBDCs –CBN – The Sun Nigeria

By Chinwendu Obienyi Month after launching the digital currency eNaira, the Central Bank of Nigeria (CBN) criticized commercial banks for its lack of adoption. This was even as the apex bank revealed that it was set to conclude trials with MTN Nigeria to provide a channel where the unbanked can …

Read More »Mortgage boycott risks are manageable for China’s banking system, but small lenders are vulnerable, experts say

China’s banking sector has enough buffers to avoid an explosion of non-performing loans, as the ongoing revolt of mortgage borrowers is limited to small towns, which can be combated once financial regulators address the cause of their grievances. , according to industry analysts. The mainland’s banking system is able to …

Read More »Indira Gandhi nationalized 14 commercial banks on July 19, 1969.

Some of these banks included Bank of Baroda, Allahabad Bank, Canara Bank, Central Bank of India and Punjab National Bank. Representative photo: iStock Fifty-three years ago on this day – July 19 – then Prime Minister Indira Gandhi announced the nationalization of 14 major commercial banks, which held 85% of …

Read More »Technology is revolutionizing America’s banking system

Long before he was a Broadway star, Alexander Hamilton was a formidable presence on another stage – in this case, the development of America’s financial system. He advocated in the late 18th century for sweeping changes, arguing for a cohesive banking system and the availability of credit. Fast forward a …

Read More »Rupee Reaches 80: Currency Hedging May Put More Pressure on INR

The Indian rupee hit 80 to the dollar on Tuesday for the first time ever and currency experts predict currency hedging by domestic importers and borrowers of foreign currency loans is likely to put further pressure on the currency national. In the first seven months of 2022, the Indian rupee …

Read More »FIA plans to counter cyberattacks on the banking system that are growing at a frightening rate

Islamabad: Federal Investigation Agency (FIA) top bosses have hatched a plan to initiate a crackdown with the help of commercial banks against telecom hackers involved in transferring large numbers of customers from different banks into their bogus accounts, the FIA says this scribe. As incidents of cyber attacks on the …

Read More »ComBank launches “Arunalu” foreign currency savings account for children

Silk Cooperation, a supply chain management company in the organic and sustainable agriculture, food and beverage and nutraceutical sector, recently announced the opening of a state-of-the-art manufacturing facility in Naula, Matale, to produce a healthy range of vegan and plant-based products. . These products are marketed and sold under the …

Read More »Nigerian Bureau de Change Operators Reject Euro Due to Currency Fluctuations

Several officials at the bureau de change in the popular Wuse Zone 4 area of Abuja, the largest black market in Abuja, said The Africa Report that the euro was too unstable and they wanted to avoid incurring losses. The few who were willing to buy euros did so at …

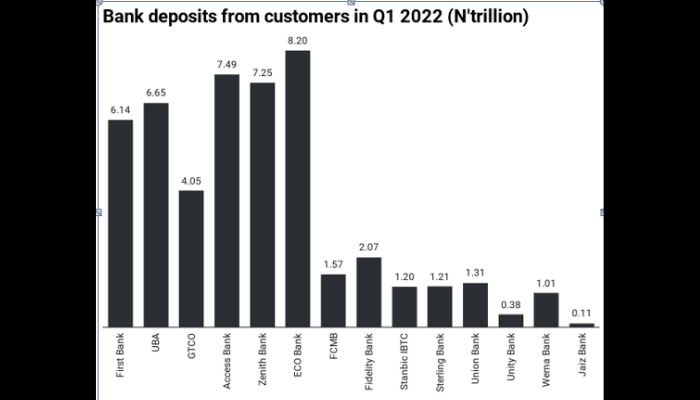

Read More »Commercial bank deposits jump 20.20% in Q1 2022

Nigerian banks received a combined deposit of N48.64 trillion naira from customers across different types of accounts in the first quarter (Q1) of 2022, or 20.20% above the N40.47 trillion collected during the comparable period of 2021. Analysis of total deposits received from customers by account type for Nigerian lenders …

Read More »Iranian exchange rates for July 14

BAKU, Azerbaijan, July 14. The Central Bank of Iran (CBI) announced an official foreign exchange rate on July 14, Trend reports referring to the CBI. According to the Central Bank of Iran’s exchange rate, 19 currencies rose and 11 fell in price, compared to July 13. According to CBI, 1 …

Read More »The slowdown in money creation could be another sign of recession

July 13, 2022 by SchiffGold 0 0 The slowdown in money creation could signal a recession. Money supply growth has fallen sharply in recent months. Measured by M2, money supply increased by 6.6% year-on-year. That was down from April’s growth rate of 8.21%. In May 2021, M2 increased by 14.30%. …

Read More »South Africa changes its banking system in line with New Zealand and Norway

In early June, the South African Reserve Bank (SARB) began its 12-week transition to a new monetary policy implementation framework. The amendments to the framework are largely technical in nature and are expected to change the way monetary policy is implemented in South Africa, according to Werkmsnas legal experts. Historically, …

Read More »UK think tank calls for global digital currency rules

Global rules would allow central bank digital currencies to operate smoothly across borders and speed up wholesale payments, a think tank backed by the City of London Corporation said on Friday. Most central banks, including the Federal Reserve, Bank of England and European Central Bank, are investigating the potential launch …

Read More »Monetary values in terms of special drawing rights – Markets

WASHINGTON: The International Monetary Fund (IMF), Treasury Department currency values in terms of Special Drawing Rights (SDRs). ====================================================================================== July 06, 2022 ====================================================================================== Currency units per SDR SDR per Currency unit ====================================================================================== Currency 5-Jul-22 1-Jul-22 30-Jun-22 29-Jun-22 ====================================================================================== Chinese yuan 0.112825 0.11216 0.112496 0.111938 Euro 0.777582 0.783897 0.782282 0.789041 Japanese yen …

Read More »2022-07-05 | NDAQ:COLB | Press release

Veteran Bankers Jeffrey Thomas, James Diver to provide business loan services TACOMA, Wash., July 5, 2022 /PRNewswire/ — Columbia Bank, the wholly owned subsidiary of Columbia Banking System, Inc. (NASDAQ: COLB) (“Colombia“), today announced the expansion of its business lending division to Utah with veteran hires Salt Lake City– regional …

Read More »India’s Stance on Crypto Currency Justified by Global Trends

NNA | Updated: Jul 05, 2022 07:48 STI By Lee Kah WhyeSingapore, Jul 5th (ANI): India’s conservative stance on not encouraging cryptocurrency is quickly vindicated by the negative experiences of various Crypto Funds, the latest being Singapore’s Three Arrows Crypto Fund . Experts say India correctly predicted economic headwinds and …

Read More »We’re on track for a currency crisis – and bankruptcy

No wonder the government still refuses to commission an economic impact assessment of Brexit; the results would not reflect our exit agreement well. Under these circumstances, it is perhaps surprising that the pound is not under more pressure in the currency markets than it is. So far this year, it …

Read More »Columbia Banking System Announces Second Quarter 2022 Earnings Release and Conference Call Date | PR Newswire

TACOMA, Wash., June 30, 2022 /PRNewswire/ — Columbia Banking System, Inc. (“Columbia” NASDAQ: COLB) expects to release its second quarter 2022 financial results before market open on Thursday, July 21, 2022. Management will discuss these results on a conference call scheduled for Thursday, July 21, 2022 at 11:00 a.m. Pacific …

Read More »Columbia Banking System Announces Second Quarter 2022 Earnings Release and Conference Call Date

TACOMA, Wash., June 30, 2022 /PRNewswire/ — Columbia Banking System, Inc. (“Columbia” NASDAQ: COLB) expects to release its second quarter 2022 financial results before market open on Thursday, July 21, 2022. Management will discuss these results on a conference call scheduled for Thursday, July 21, 2022 at 11:00 a.m. Pacific …

Read More »Digital ID and KYC infrastructure key to rollout of digital currency, says IMF

An international agency is urging central banks to help strengthen national digital ID systems and make it easier to enforce KYC requirements. The International Monetary Fund (IMF) says in one of its latest reports that digital currency rollout is gradually gaining traction in Sub-Saharan Africa, but countries need to build …

Read More »Growing Growth of Banking System Software – Designer Women

Marketreports.info analysts forecast the latest report on “Global Banking System Software Market (Covid-19) Impact and Analysis by 2030,” according to Banking System Software Report; The Banking System Software Market report covers the overall and all-inclusive analysis of the Banking System Software Market with all its factors that have an impact …

Read More »Design of banknotes and printing of currencies: the 2022 market is booming in the world

Banknote Design and Money Printing Market 2022 this report is included with the Impact of latest market disruptions such as Russian-Ukrainian war and COVID19 outbreak impact analysis key points influencing market growth. In addition, the market for banknote design and currency printing (By Major Key Players, By Types, By Applications …

Read More »Columbia Banking System (NASDAQ:COLB) vs. Univest Financial (NASDAQ:UVSP) Head to Head Comparison

Columbia Banking System (NASDAQ:COLB – Get Rating) and Univest Financial (NASDAQ:UVSP – Get Rating) are both finance companies, but which company is better? We’ll compare the two companies based on their dividend strength, analyst recommendations, risk, valuation, profitability, institutional ownership and earnings. Dividends Columbia Banking System pays an annual dividend …

Read More »The Fed praises the soundness of the banking system in its supervision report

This article is part of a series titled “Supervise the financial institutions of our country. Banking conditions in the United States remained generally strong in the second half of 2021, with strong capital and liquidity, in addition to improving asset quality. This is the conclusion of the Board of Governors …

Read More »Opinion: Reform the banking system, not Big Society Capital | The social enterprise magazine

In May 2022, Big Society Capital (BSC) announced that it was reducing its target rate of return from 4-5% to 1%. While this change is welcome, BSC with its £600m is part of a market it estimates to be worth £6.4bn (2020 data). Commercial banks and other lenders had £464bn …

Read More »The latest currency war may just be a skirmish

Placeholder while loading article actions There is a lot of turmoil in the forex market about a new “currency war” breaking out, with countries and central banks taking steps to prop up their weakened currencies to offset the strengthening US dollar. The last currency war was a decade ago, but …

Read More »Foreign exchange software market – growing demand from professionals in the sector: Fourex, FX PLUS, Cymonz, Calyx Solutions

JCMR released a new industry study that focuses on Global Currency Exchange Software Market and provides in-depth market analysis and future outlook of Global Currency Exchange Software Market . The study covers important data that makes the research document a handy resource for managers, analysts, industry experts, and other key …

Read More »Commercial banks resume payment of dividends

Anne Juuko, Managing Director of Stanbic Bank Uganda. Picture file Kampala, Uganda | THE INDEPENDENT | Shareholders of banking services companies will start receiving dividends for their investments within a month, for the first time since 2019. Stanbic Bank Uganda and Bank of Baroda will be the first to pay …

Read More »Media agency Horizon to test Comscore data as local ad currency

Media agency Horizon Media said it was working with Comscore on a test to see if Comscore’s local TV measurement data can be used as currency when planning and buying local TV ads. Comscore would offer local buyers an alternative to Nielsen, which has long dominated the ratings industry. Comscore …

Read More »Reduce “ridiculous” high interest rates – Kennedy Agyapong to commercial banks

Kennedy Agyapong, MP for Assin Central The cost of credit remains high in Ghana – Report Development Bank Ghana launched to support specific sectors DBG must deal directly with companies – Kennedy Agyapong Businessman, Kennedy Agyapong has called on commercial banks operating in the country to cut their interest rates …

Read More »“Ghana’s commercial banks are not supporting agriculture enough”

Ghana’s Minister of Agriculture, Owusu Afriyie Akoto, said that although the government had done its best to boost food production by subsidizing the prices of agricultural inputs, such as chemicals, banks had not granted enough loans to complete this effort. This, according to the minister, had made the prices of …

Read More »Swiss demand deposits fall, indicating reduced intervention in the foreign exchange market

The level of Swiss demand deposits fell slightly, data showed on Monday, indicating that the Swiss National Bank has scaled back its foreign exchange market interventions aimed at weakening the Swiss franc. The total level of overnight deposits – cash held overnight by commercial banks with the SNB – fell …

Read More »Exchange rates in Pakistan – Dollar, Euro, British Pound and Riyal rates on June 19, 2022

Today’s exchange rates in Pakistan on June 19, 2022, current dollar rate in Pakistan, latest exchange rates for British Pound, Euro, Saudi Riyal, UAE Dirham, Canadian Dollar , Australian dollar to Pakistani rupees. All rates updated based on free market exchange rates. Today’s exchange rates in Pakistan according to international …

Read More »World Bank Says Nigeria’s Central Bank’s Low-Interest Loans Are Undermining Commercial Bank Funding In Certain Sectors

The World Bank has said the Central Bank of Nigeria’s low interest lending undermines commercial banks that lend on a risk-adjusted pricing basis and must be curtailed This was revealed by the World Bank in a document titled “Nigeria Development Update (June 2022): The Continuing Urgency of Unusual Cases.’ The …

Read More »Russian currency plunges on call to end capital controls

The Russian ruble fell on Thursday after the head of the central bank said most currency controls should be removed. “We had an overlay of currency restrictions. My opinion is that they should be removed, most of them anyway,” Governor Elvira Nabiullina said. The ruble had previously fallen under Western …

Read More »Columbia Banking System (NASDAQ:COLB) sets new 1-year low at $27.21

Columbia Banking System, Inc. (NASDAQ:COLB – Get Rating) stock price hit a new 52-week low during Thursday’s session. The company traded as low as $27.21 and last traded at $27.24, with trading volume of 2398 shares. The stock previously closed at $28.42. A number of analysts have published reports on …

Read More »Sri Lankan Commercial Bank Rupee Quotation Drops Slightly Amid Trade Gloom

ECONOMYNEXT – Three deaths have been reported due to prevailing weather conditions in Sri Lanka with the onset of the southwest monsoon. Heavy rains are expected to continue in the western, southern and southwestern provinces of the country, officials from the Disaster Management Center (DMC) said. Due to heavy rains …

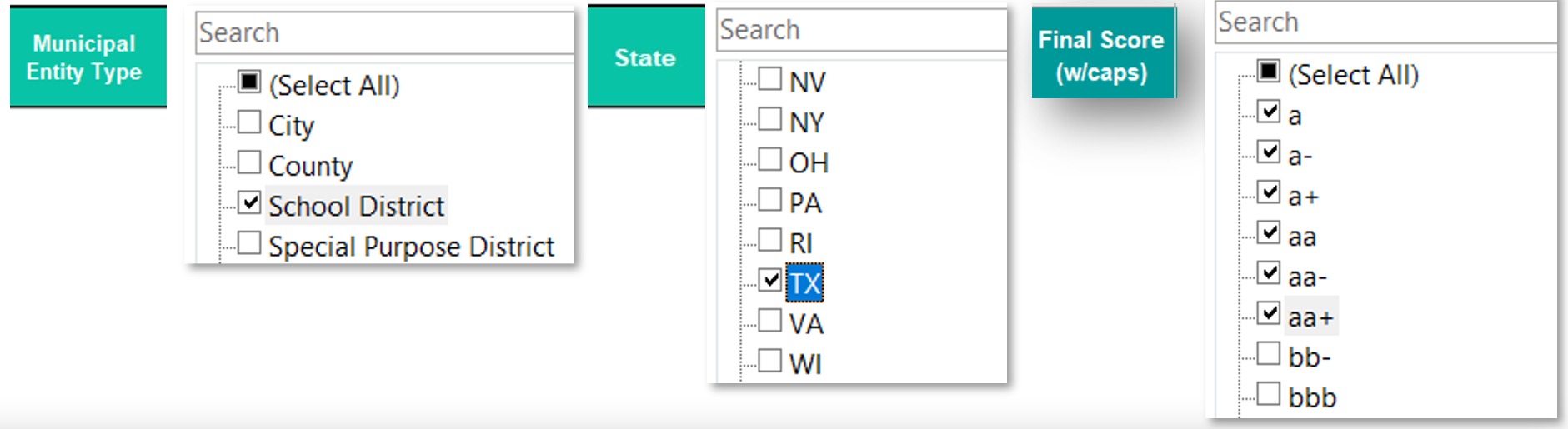

Read More »Commercial Banks Five Ways to Grow Your Business and Cut Costs

In today’s complex and rapidly changing environment, companies face the same challenge: to grow their business while reducing their expenses. In this blog, we will review five ways commercial banks are approaching these cost savings for the municipal segment. Finding new lending and investment opportunities through municipal market prospecting Finding …

Read More »fixed deposit rate increased by many commercial banks after reserve bank of india increased repo rate

zeenews.india.com understands that your privacy is important to you and we are committed to being transparent about the technologies we use. This Cookie Policy explains how and why cookies and other similar technologies may be stored on and accessed from your device when you use or visit the zeenews.india.com websites …

Read More »Currency Exchange Software Market Size and Forecast to 2028 | Clear View Systems, Calyx Solutions, Onboard Software, Cymonz, Donya Exchange

There “Currency Exchange Software Market » the research examines the market estimates and forecasts in great detail. It also facilitates the execution of these results by demonstrating tangible benefits to stakeholders and business leaders. each company must anticipate the use of its product in the longer term. Given this level …

Read More »Iranian exchange rates for June 13

BAKU, Azerbaijan, June 13. The Central Bank of Iran (CBI) announced the official foreign exchange rate on June 13, Trend reports referring to the CBI. According to the Central Bank of Iran’s exchange rate, 15 currencies rose and 12 fell in price, compared to June 11. According to CBI, 1 …

Read More »India among 12 economies on US Treasury currency watch list

On Friday, India remained on the US Treasury Department’s currency watch list of major trading partners, as Washington placed India along with 11 other major economies that deserve close attention to their monetary practices and policies. macroeconomics. The countries are China, Japan, South Korea, Germany, Italy, …

Read More »Opinion: China’s central bank digital currency could revolutionize global trade

World trade is dominated by the US dollar, euro, Japanese yen and British pound. The Chinese yuan has a share of about 3%, although China is the largest trading partner for most of the world. As the world’s largest trading nation and at the center of many of the world’s …

Read More »Cooperative banks allowed more business on par with commercial banks

Cooperative banks will be eligible for more services on an equal basis with commercial banks. Besides tightening limits on home loans, some will now be allowed to lend to commercial real estate. In addition, urban cooperative banks will also be allowed to offer home banking services to their customers. “In …

Read More »BGaming Adds Crypto SNACK Currency to Its iGaming Products

TALLINN, Estonia, June 7, 2022 /PRNewswire/ — Award-winning gaming studio BGaming, a pioneer in crypto-gaming, now supports Crypto SNACK as a currency. This addition puts the SNACK Crypto Token among its impressive portfolio, comprising more than 80 products such as video slots, video poker, lottery, card games and casual games …

Read More »liabilities and net worth of commercial banks? – ictsd.org

The main source of bank liabilities is its capital (including cash reserves and, in many cases, subordinated debt). This can come from a domestic or foreign source (corporations and businesses, individuals, other banks and even governments). How much is commercial banking worth? the commercial bank in US market size in …

Read More »Global Automatic Currency Detector Market Size 2022 Booming By Share, Growth Size, Scope, Key Segments And Forecast To 2029

New Jersey, United States – The Global Automatic Currency Detectors Market report examines the current status of the global Automatic Currency Detectors market and industry in detail. All necessary data or information such as market terminologies, concepts, segmentation, key players and other critical information is included in the study. Company …

Read More »Head-to-Head Poll: Sierra Bancorp (NASDAQ:BSRR) vs. Columbia Banking System (NASDAQ:COLB)

Sierra Bancorp (NASDAQ:BSRR – Get Rating) and Columbia Banking System (NASDAQ:COLB – Get Rating) are both finance companies, but which company is the best performer? We’ll compare the two companies based on the strength of their profitability, valuation, earnings, institutional ownership, analyst recommendations, risk, and dividends. Dividends Sierra Bancorp pays …

Read More »The government is not convinced that the digital currency can withstand fraudsters

A depiction of the Bank of Jamaica (CBDC) central bank digital currency, Jam-Dex logo and slogan. Scammers and other fraudsters will not be able to use central bank digital currency (CBDC) in their illicit activities, the government has promised. Closing the debate on amendments to the Bank of Jamaica (BOJ) …

Read More »Ghana: Commercial Banks Show Resilience Despite Inflation and Currency Depreciation

(Ecofin Agency) – Ghana’s economy is currently affected by high inflation and a weak currency. Commercial banks have resisted so far, but it is uncertain whether their performance will remain as strong as in 2021. Despite the current economic environment, commercial banks operating in Ghana are showing signs of resilience. …

Read More »HPE slashes full-year earnings forecast on currencies, supply chain and Russia

(Bloomberg) – Hewlett Packard Enterprise Co. fell about 6% in extended trading after lowering its full-year profit forecast, citing unfavorable currency movements, supply chain disruptions and the impact of leaving the Russian market. Earnings, excluding certain items, will be $2.10 per share in the year, seven cents per share lower …

Read More »Transfer of funds outside the formal banking system

This content was provided by a business partner. I have seen an increasing number of customers asking about overseas payments. Recently, this has been driven by a number of particularly difficult situations that have made using the formal banking system either difficult or impossible. Often, decisions must be made at …

Read More »UK payments platform xpate launches core banking system

London-based cross-border payments platform xpate has launched a new core banking solution to simplify merchant payment system integrations with multiple acquirers. xpate launches its own core banking platform Xpate says its cloud-based solution will give merchants “the widest possible access” to integrated payment processing, real-time data analytics and transaction routing …

Read More »China pilots NFC devices that combine digital currency payments with student cards • NFCW

NFC PAYMENTS: The palm-sized device is a combination student card, phone, and digital yuan hard wallet Students attending Hainan Lu Xun Middle School in the Chinese city of Sanya are the first in the country to test a yuan-denominated digital wallet device that allows them to make payments to designated …

Read More »The main liabilities of commercial banks are ? – ictsd.org

The bank’s most significant liabilities are capital (mainly cash reserves and, in some cases, subordinated debt) and deposits. It can be obtained from domestic or foreign sources (companies, businesses, individuals, other banks and even governments). What is the greatest responsibility of a commercial bank? The bank is most vulnerable to …

Read More »Currency Counting Machines Market Size and Forecast

New Jersey, United States – Verified Market Reports has released the latest competent intelligence market research report on the Currency Counting Machines market. The report aims to provide an in-depth and accurate analysis of the Currency Counting Machines market, taking into account market forecasts, competitive intelligence, technical risks, innovations, and …

Read More »Do commercial banking system liabilities include? – ictsd.org

The bank’s liabilities include its capital (including cash reserves and, occasionally, subordinated debt) and deposits. Foreign governments, companies and individuals may also provide (although not directly related). What is the main responsibility of the commercial bank? Deposits are the most common type of liability for commercial banks. Deposits are a …

Read More »Blockchain Lawyers & Lawyers | digital currency

The sudden and rapid rise of Bitcoin, Ethereum, and other cryptocurrencies over the past few years, coupled with the potential applications of blockchain and distributed ledger technologies in virtually every industry, has generated a wave of innovation, disruptive businesses and a modern digital economy. With this explosive growth, new legal …

Read More »Capital and liquidity reserves make the banking system crisis-proof

Hungary’s banking system was in a “state of readiness” as it faced a sharp increase in risk due to the war in Ukraine, and the sector’s capital and liquidity buffers ensure that lenders will be resilient even if the conflict extends, the National Bank of Hungary (NBH) said in a …

Read More »US Commercial Banks Report 22% Drop in Overall Net Profit for Q1 2022

Changes in banking are now happening at an accelerating pace, a bank is now seeing changes in a year that took decades to materialize. These changes are reflected in loan-to-deposit ratios as well as what is on banks’ balance sheets, which in turn influences bank performance. Banking sector quarterly net …

Read More »Lebanese currency hits new low after vote, crisis deepens

BEIRUT (AP) — Lebanon’s currency hit a new low on Tuesday as deep divisions in the newly elected parliament raised fears that political paralysis could further exacerbate one of the worst economic collapses in history. The legislature elected on May 15 showed no clear majority for any group and a …

Read More »Columbia Banking System (NASDAQ:COLB) Stock Rating Downgraded by Zacks Investment Research

Columbia Banking System (NASDAQ:COLB – Get an Assessment) was downgraded by Zacks Investment Research from a “buy” rating to a “hold” rating in a research report released Friday to clients and investors, Zacks.com reports. According to Zacks, “Columbia Banking System, Inc. is a registered bank holding company whose wholly-owned subsidiary, …

Read More »Sri Lanka limits currency holdings amid crisis

Sri Lanka’s central bank said it would reduce the maximum amount of foreign currency individuals can own from $15,000 to $10,000 and penalize anyone who holds it for more than three months By Bharatha Mallawarachi Associated Press May 19, 2022, 3:45 p.m. • 3 minute read Share on FacebookShare on …

Read More »Construction of a factory to print money and launch of security documents

The Uganda Security Printing Company (USPC) yesterday started construction of the security printing factory in Entebbe. USPC was established on October 4, 2018 as a joint venture between the Ugandan government and a German consortium Veridos. The partnership aims to revamp the Uganda Printing and Publishing Corporation (UPPC) by redesigning, …

Read More »Could stablecoin regulation pose a new risk to the banking system?

WASHINGTON — When it comes to major market turbulence, banks escaped last week’s TerraUSD crash largely unscathed. Terra and its corresponding crypto coin Luna fell last week, losing almost all of their value and sending the crypto market into a selloff. It was an existential moment for crypto proponents and …

Read More »The Development of E-HKD in Hong Kong – The Future Way of Currency?

A study shows that 90% of interrogates central banks around the world are exploring the future issuance of central bank digital currencies (CBDCs). Blockchain.News interviewed industry experts to find out the prospects for Hong Kong’s digital currency and its potential adoption. The outlook for e-HKD In a recent discussion paper …

Read More »John Ryan, staunch defender of dual banking, dies at 58

John Ryan, a passionate advocate of dual banking and a driving force as chairman and chief executive of the Conference of State Banking Supervisors, where he worked for 25 years, died suddenly late Monday night at his home in Washington. He was 58 and died of natural causes, said CSBS …

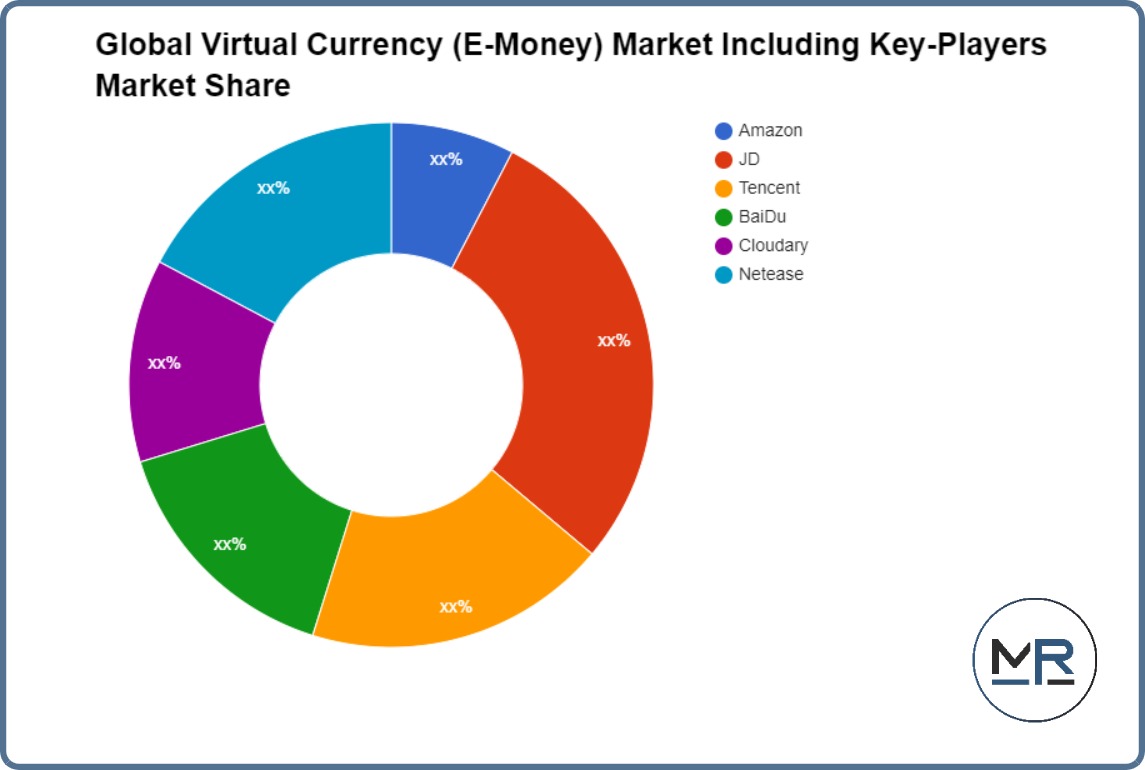

Read More »Size, cost structures, growth rate – SMU Daily Mustang

Exclusive Virtual Currency (Electronic Money) Market Research Report provides in-depth analysis of market dynamics across five regions such as North America, Europe, South America, Asia- Pacific, Middle East and Africa. Segmentation of Virtual Currency (Electronic Money) Market by Type, Application and Region has been done based on in-depth market analysis …

Read More »OFAC Imposes First-Ever Sanctions Against Virtual Currency Mixer – Export Controls and Trade and Investment Sanctions

To print this article, all you need to do is be registered or log in to Mondaq.com. On May 6, 2022, the United States Department of Treasury’s Office of Foreign Assets Control (“OFAC”) designated crypto mixer Blender.io as a Specially Designated National (“SDN”), marking the first time a virtual currency …

Read More »InventHelp Inventor develops disinfection device for paper money (LUW-201) | News

PITTSBURGH, May 10, 2022 /PRNewswire/ — “My uncle owns a gas station and a lot of paper money changes hands. I thought there should be a way to sanitize money to prevent the spread of germs,” said an inventor, Louisville, Ky.“So I invented the CASH DISINFECTANT. My design eliminates the …

Read More »Venezuela Bets on De-Dollarization After Enforcement of Currency and Crypto Tax CryptoBlog

The Venezuelan government is now focusing its action on trying to establish the bolivar as the reference currency for purchases in the country. According to several economists, this could be a risky bet in a country which has just emerged from hyperinflation and which still suffers from high levels of …

Read More »Commercial bank deposits rise 2.4% to QR 967.7 billion in March

Doha: Qatar’s banking sector continued to record robust growth in March as the country’s commercial banks recorded an increase in deposits and credit facilities, according to the latest data released by the Planning and Statistics Authority (PSA). According to the report, cash equivalents including commercial bank deposits in Qatar stood …

Read More »Review of Surrey Bancorp (OTCMKTS:SRYB) and Columbia Banking System (NASDAQ:COLB)

Surrey Bancorp (OTCMKTS:SRYB – Get Rating) and Columbia Banking System (NASDAQ:COLB – Get Rating) are both finance companies, but which company is the best performer? We’ll compare the two companies based on the strength of their profitability, valuation, institutional ownership, dividends, analyst recommendations, risk and earnings. Dividends Surrey Bancorp pays …

Read More »“Commercial court to deal with currency manipulations” – RBZ

The Reserve Bank of Zimbabwe says deterrent sanctions are needed if the country is to deal with currency manipulators once and for all. Over the past two years, the country’s macro-economic environment has been besieged by economic saboteurs, who have manipulated the local currency to the chagrin of Zimbabweans. The …

Read More »Islamic Banking Market research report explores growing trends with business developments and forecast to 2028

SMI offers a complete study of the “Islamic banking marketwith all-inclusive insights into vital factors and aspects that impact the future growth of the market. The report’s segmentation analysis has provided the performance of different product segments, applications, and regions in the Islamic Banking System market. This report covers the …

Read More »Fed Report: Banking System Remains Strong, Fintech Risk Assessment Intensifies

The banking system remained broadly sound, with strong capital and liquidity and improving asset quality in the second half of 2021, according to the Federal Reserve’s latest supervisory and regulatory report released today. The Fed said risk monitoring will continue for the potential effects of the pandemic and new geopolitical …

Read More »Winds for credit growth in the banking system in the short term; but headwinds are emerging in the medium term

Banking system credit growth recorded a significant recovery at the start of FY23, with credit growth of 11.2% year-on-year as of April 8, 2022, compared to 5.3% year-on-year during FY23. same period in April 2021, and the highest since July 2019. India Ratings and Research (Ind-Ra) estimates that while the …

Read More »COLUMBIA BANKING SYSTEM, INC. MANAGEMENT REPORT ON FINANCIAL POSITION AND RESULTS OF OPERATIONS (Form 10-Q)

This discussion should be read in conjunction with the unaudited Consolidated Financial Statements of Columbia Banking System, Inc. (referred to in this report as "we", "our", "Columbia" and "the Company") and notes thereto presented elsewhere in this report and with the December 31, 2021 audited Consolidated Financial Statements and its …

Read More » I Have 50 Dollars

I Have 50 Dollars