Many longtime readers will know that I have often spoken of the existence of a glut of savings publish.

Or – said in another way – there has been too much liquidity in the global financial system with a lack of attractive investments. . .

So – I think it’s safe at this point to say that the credit is not the problem. But rather banks and other lenders finding places to put everything.

This is the main reason why the world’s central bankers got stuck in their aggressive easing policies.

Meaning: they can print and facilitate as much as they want (which they have). But if it doesn’t get into the mainstream economy (which it didn’t) then all it does is fuel a glut of savings, excessive speculation, and further inequality.

And – today – saw another one A key symptom of this glut of savings problem in the Federal Reserve’s overnight repo facility (aka the RRP facility). . .

(To give you a bit of background: the RRP facility is known as the ‘last resort’ for banks and money markets. Institutions prefer to put that money aside for zero return instead of paying interest to keep that money. internally).

Over the past few weeks – the big banks and financial firms have been shoveling a registration amount of excess cash – nearly $ 600 billion – in the RRP installation.

(Note that this is the exact opposite of the dollar shortage situation that was brewing in 2019 – which I wrote about here).

And – to make things more interesting – these same banks have asked large depositors (like business accounts) to take their money somewhere else because they don’t know what to do with it.

Keep in mind that – usually – high deposit rates are what banks to want – give them fuel to make more loans. (Remember: the difference between what the bank lends in cash and what it pays depositors is their profit).

But – the problem today is that the banks are not make as many loans. . .

In fact – to put it in perspective: total loans from banks accounted for only 61% of all deposits at the end of May. Down from 75% in February last year – a multi-decade low.

(One of the main reasons for this drop in lending is that companies can access cheaper money directly from yield-hungry investors. Either by issuing bonds or stocks).

So as new loans decline while deposits soar, bank margins have shrunk. And without the RRP facility – various short-term market rates would most likely be negative (via depositor fees or lower returns) in the midst of this glut of savings.

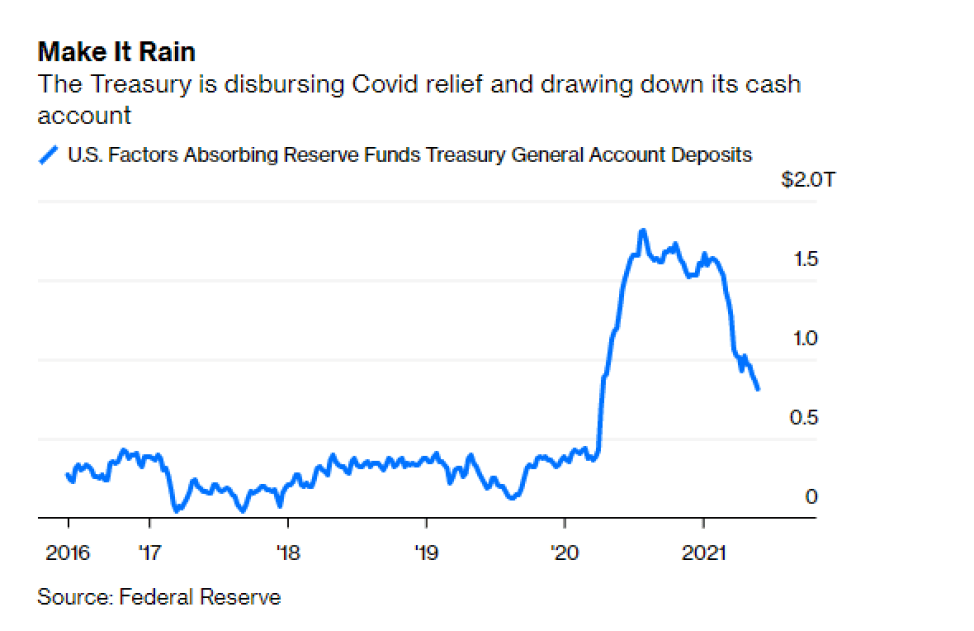

And – making matters worse – the General Treasury Account (aka the government bank account at the Fed) was liquidate in the last 6 months. . .

(Which means: the Treasury spends the money on their account via stimulus payments to citizens, local and state governments, etc. Which then ends up in commercial banks and money market funds. Make the glut even worse).

Therefore – it is not surprising then why today the Fed raised their day-to-day RRP rate of 0.05% for help prevent rates from turning negative as liquidity overwhelms the banking system.

But – this glut still has the potential to get worse. . .

This is because the Fed keep on going buy $ 120 billion in bonds per month through QE (quantitative easing). So far, totaling more than $ 2.5 trillion since the start of the pandemic in early 2020.

This puts the banking system in a very special situation:

On the one hand, the Fed is busy pumping out huge amounts of money in the banking system (via QE).

But on the other hand, investors and banks are giving this money away return to the Fed via the RRP facility. . .

So – in short – there is a glut of savings that creates bigger distortions and fragility of the banking system.

And while the Fed continues to pump money into the system – hopefully it will spur new investment and growth. All it does is create waves of unintended consequences (such as bad investment, moral hazard, new inequalities and asset bubbles).

This is because there is a global lack of investment – a structural problem – which cannot be corrected by the cyclical tools of the Fed.. . .

And while many believe new loans will increase as the economy returns to normal, fueling inflation and growth – I remain skeptical.

Why?

Because this structural savings glut plagued the global economy for decades (since the 1980s – but I’ll write more about this later). . .

So, I expect more deflation, weaker growth, and lower rates. Because as stated above – it is not the money supply that is the problem. But the lack of places to put everything.

And until that changes – it’s hard to believe the anemic trend in global growth will be too. . .

For example: as we saw first with the Bank of Japan – then the European Central Bank. Injecting credit into places where demand is falling is more harmful than anything else.

But as usual, only time will tell. . .

I Have 50 Dollars

I Have 50 Dollars